Off Business has become one of India’s most successful B2B giants, outshining companies like Zera, Zato, and Lenscart in terms of revenue. Despite its remarkable success, the company remains largely unknown to the public. In this post, we delve into the story of Off Business, exploring the key strategies and insights that helped it build a ₹41,000 crore empire with a profit after tax (PAT) of over 400 crores. Here are the four critical insights that helped them dominate the unsexy B2B industry.

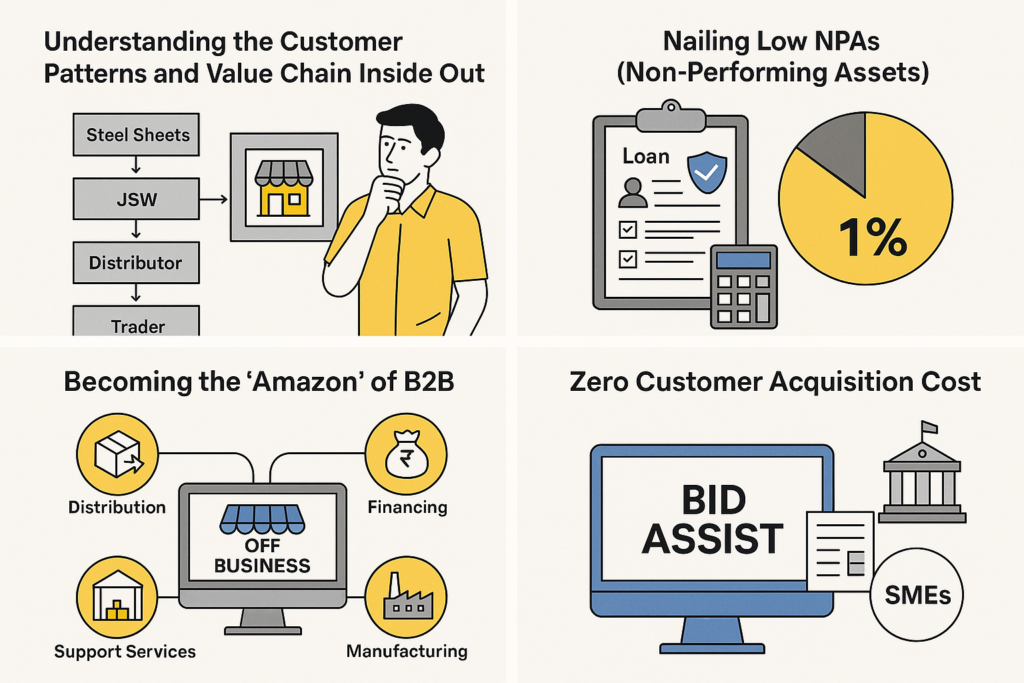

1. Understanding the Customer Patterns and Value Chain Inside Out

Off Business entered the B2B market in 2015, focusing on the raw materials segment of the MSME (Micro, Small, and Medium Enterprises) sector. Despite raw materials having lower margins than other categories, they provided a unique advantage—higher frequency of capital turns. The raw material side of the supply chain is highly fragmented, with fewer distributors and thinner margins, making it easier for Off Business to find opportunities.

To understand the supply chain, let’s take steel sheets as an example. Steel manufacturers like JSW supply raw materials through distributors, who then sell to traders and SMEs. This multi-layered supply chain results in expensive raw materials as they move down the chain. Off Business simplified this by cutting out the middlemen and offering suppliers direct visibility of their end customers, reducing inefficiencies in the process.

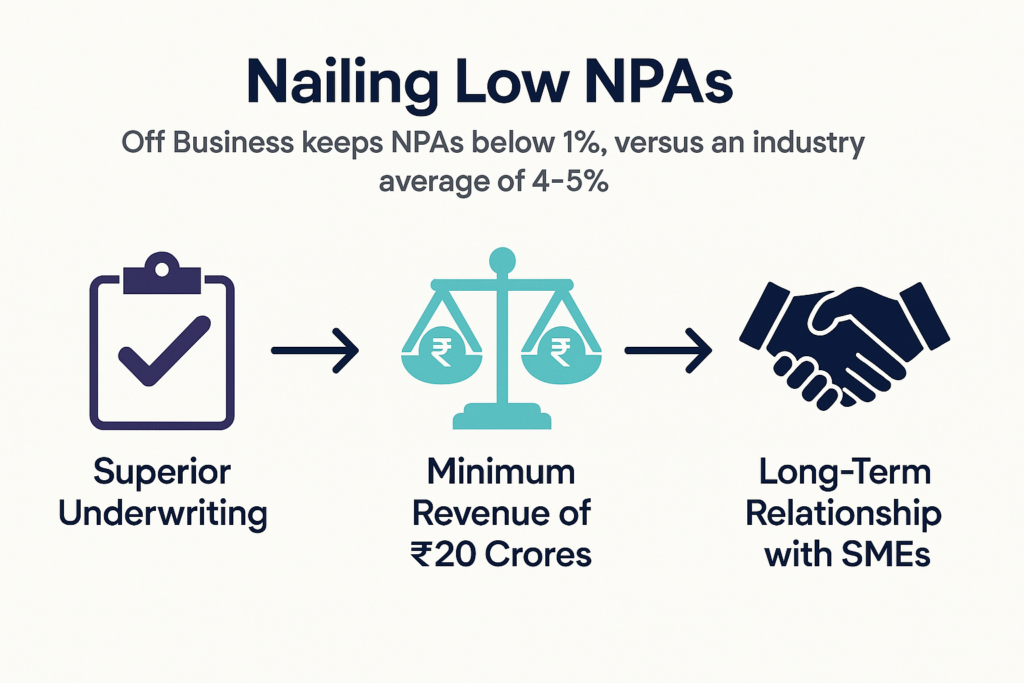

2. Nailing Low NPAs (Non-Performing Assets)

In the world of B2B lending, minimizing Non-Performing Assets (NPAs) is crucial. With an industry average NPA rate of 4-5%, Off Business managed to keep its NPAs below 1%. How? Through superior underwriting (evaluating creditworthiness) and collections (recovering payments). Off Business only lends to SMEs with a minimum revenue of ₹20 crores and a solid credit profile, ensuring they are more likely to pay back on time. Their long-term relationship with SMEs also helps ensure timely payments.

3. Becoming the ‘Amazon’ of B2B

Off Business has successfully diversified into four areas of the B2B value chain—distribution, financing, support services (warehousing, quality checking, logistics), and manufacturing. Their smart expansion into manufacturing, which now comprises 27% of their business revenue, was driven by data insights. They saw opportunities in raw material manufacturing when there was a demand shortage. Through strategic acquisitions, they expanded their manufacturing capabilities and strengthened customer loyalty by providing more value-added services.

4. Zero Customer Acquisition Cost

One of the most brilliant aspects of Off Business’s strategy is its customer acquisition tool, Bid Assist. Instead of spending on traditional marketing, Off Business created a platform that helps SMEs find government tenders. By leveraging AI, Bid Assist analyzes tenders and determines their eligibility, offering a success rate probability. This has attracted over 20 lakh SMEs, creating a valuable customer base without any traditional advertising spend. This zero customer acquisition cost model has allowed Off Business to scale rapidly while keeping overheads low.

Conclusion: The Success Formula Behind Off Business

Off Business has shown that with a deep understanding of the customer and value chain, innovative business models, and low-cost acquisition strategies, it is possible to build a multi-billion-dollar company in an unglamorous industry. By focusing on the B2B sector, particularly MSMEs, Off Business was able to spot gaps in the market and provide real, actionable solutions that drive both profitability and growth. Their unique approach to raw materials, financing, and customer acquisition has set them apart from competitors, and their success is a testament to the power of understanding market nuances and continuously innovating.

FAQ

1. What is Off Business and what do they do? Off Business is a B2B platform that connects suppliers of raw materials with MSMEs (Micro, Small, and Medium Enterprises), eliminating intermediaries. They offer financing solutions, logistics support, and improved visibility for both suppliers and buyers.

2. How does Off Business manage to keep its NPA rate so low? Off Business manages to keep its Non-Performing Assets (NPA) rate below 1% by conducting thorough credit checks and lending only to creditworthy businesses. They also maintain long-term relationships with SMEs, which encourages timely repayments.

3. What makes Off Business different from traditional B2B distributors? Off Business stands out by offering direct visibility of end customers to suppliers, reducing inefficiencies in the supply chain. They also offer financing options, improving credit terms for SMEs and reducing the reliance on traditional, costly credit cycles.

4. How does Bid Assist help SMEs? Bid Assist is a tool that helps SMEs find relevant government tenders. It uses AI to analyze tenders and predicts the chances of winning them, making it easier for SMEs to identify lucrative opportunities without the need for complex manual searching.

5. Why is Off Business considered a “unicorn”? Off Business is valued at ₹41,000 crores and is considered a unicorn because of its rapid growth, profitability, and innovative approach to solving problems in the B2B sector. It has also expanded its reach through strategic acquisitions and a solid customer base.