Introduction

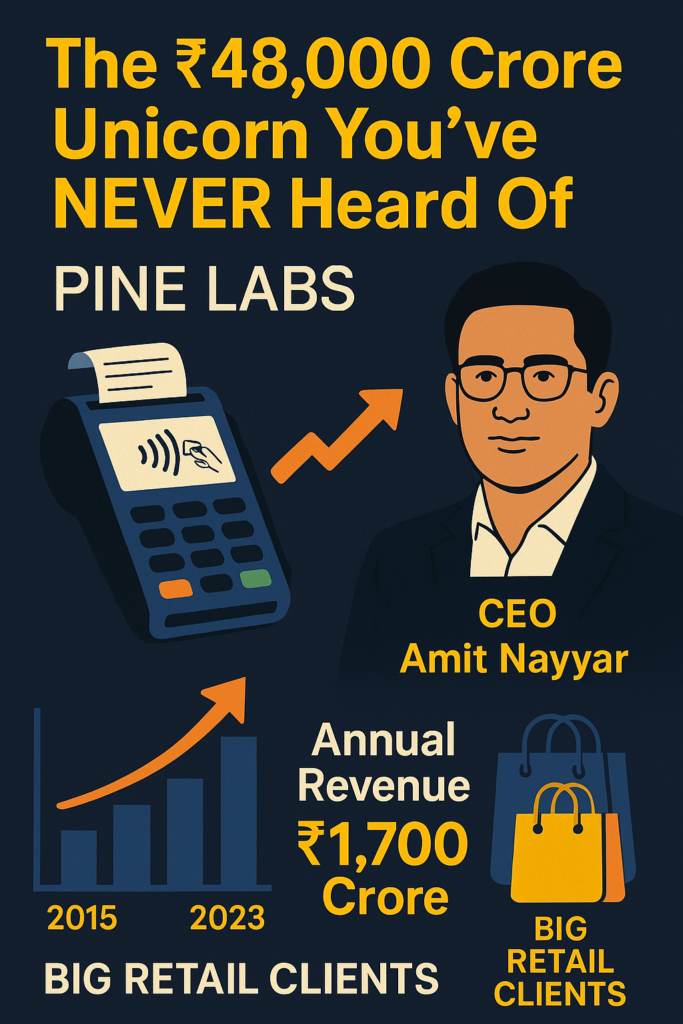

Remember the last time you swiped your card or used UPI at your favorite store or restaurant? What if I told you that there’s a 99% chance that you were dependent on the same company’s machines for all of these transactions? This company is the unspoken giant in the fintech world, making over ₹1,700 crores in yearly revenues and set to be one of the hottest IPOs this year.

In this blog, we’ll cover everything that Pine Labs has cracked to become the payment king of India.

The Origins of Pine Labs

Pine Labs is not a new-age startup. Their roots go back more than 20 years to 1998 when three co-founders took a bet on modern payments at petrol pumps using loyalty-based cards. However, the journey was far from smooth. Two out of the three co-founders left early on, leaving one co-founder, L, to steer the company through multiple pivots.

Now, Pine Labs is led by CEO Amish Ra, with L still serving as chairman. Between 2000 and 2010, the company primarily served petrol companies, offering technology solutions for fuel machine synchronization. This early focus on software and hardware integration laid the foundation for Pine Labs’ dominance in the payments space.

Cracking the Payment Game

Pine Labs leveraged a first-mover advantage in India’s rapidly evolving financial landscape. Their success wasn’t just about having the best devices but also about implementing the right retention, acquisition strategies, and technology. Interestingly, most POS devices are manufactured by Chinese companies like Pax Technologies. However, between 2005 and 2015, card payments weren’t taken seriously due to fraud and non-payments. That changed in 2016 with demonetization, which cemented digital payments as India’s new norm.

As a result, credit card transactions have increased tenfold since 2015. Despite UPI growth, credit card usage continues to rise, with annual spending per card averaging ₹2 lakhs.

Beating the Competition

Pine Labs faced competition from banks and players like Mswipe, Ezetap, Innov8, Paytm, Mobikwik, and Razorpay. However, they solved three critical market problems:

- Fast and Versatile Devices – Retailers wanted POS systems that supported QR codes, EMIs, and transactions from all banks.

- Lower Merchant Discount Rates (MDR) – Merchants needed lower transaction fees, which typically range from 1-3%.

- Comprehensive Retail Solutions – Businesses required real-time inventory management, billing, working capital loans, and reward programs.

By integrating all these features, Pine Labs delivered superior value beyond just payments. Their cloud-enabled Android POS devices also facilitated real-time inventory management and customer engagement programs.

Strategic Positioning: Pine Labs vs. Paytm & Razorpay

Pine Labs took a top-down approach by targeting large retail chains first, unlike Paytm (which targeted small vendors) and Razorpay (which started online before moving offline). Their first clients included Future Group and Shoppers Stop, allowing them to scale rapidly among major retail brands like Croma, Nike, McDonald’s, Apple, KFC, and Sony.

Partnership with Banks

Rather than competing directly with banks, Pine Labs collaborated with them. Many banks, including HDFC, use Pine Labs’ devices under their own brand name through white-labeling agreements. This strategy allowed Pine Labs to acquire merchants through both direct sales and banking partnerships.

Staying Relevant in the Fintech Race

The fintech competition is fiercer than ever, with every major player expanding into multiple financial services. Pine Labs is maintaining its edge by diversifying its offerings and expanding internationally. They are also targeting smaller retail merchants, including kirana stores, with devices competing directly with Paytm’s.

Retention and Expansion Strategy

Pine Labs ensures customer retention by providing a complete ecosystem of financial solutions. Their strategy revolves around Key Account Management (KAM), where they:

- Offer multiple value-added services so retailers don’t need to switch providers.

- Acquire fintech companies to enhance their service portfolio.

Some notable acquisitions include:

- Plural, Setu, and Qfix – Online payment solutions competing with Razorpay.

- Quicksilver – Gift cards and prepaid card solutions with an 80% market share.

- Saluto Wellness – Employee and staff management solutions for retailers.

By cross-selling these services to existing clients, Pine Labs increases retention and average revenue per user.

Conclusion

Pine Labs has transitioned from being just a payment solutions provider to an integrated fintech ecosystem. Their ability to innovate and retain clients has fueled their dominance in the Indian retail payments market. With a potential IPO on the horizon, their growth trajectory from ₹1,000 crore to ₹10,000 crore will be exciting to watch.

FAQs

1. What is Pine Labs?

Pine Labs is a leading Indian fintech company providing POS payment solutions, inventory management, and other financial services for retailers.

2. How does Pine Labs make money?

Pine Labs earns revenue through POS device subscriptions, MDR fees, EMI processing charges, and additional financial services.

3. How does Pine Labs differ from Paytm and Razorpay?

Unlike Paytm (bottom-up approach) and Razorpay (online-first strategy), Pine Labs focused on acquiring large retailers first through a top-down approach.

4. What industries does Pine Labs serve?

Pine Labs serves large retail brands, small merchants, and international markets, covering industries such as apparel, electronics, food, and fuel.

5. What makes Pine Labs a strong IPO candidate?

With stable revenues, strong partnerships with banks, and a diverse fintech ecosystem, Pine Labs is well-positioned for a successful IPO.

Pine Labs’ ability to adapt, innovate, and dominate the fintech space makes it one of India’s most promising unicorns.